Why VFC Is a Classic Value Trap

A textbook case of a value trap: declining demand, rising leverage, and no growth plan in sight.

Quick Overviews of the Five years Deline

From its peak above $80 in 2020, shares of V.F. Corporation (NYSE:VFC) have been in relentless decline, now trading around the $10 mark. Some investors may interpret this as a deep value opportunity and this company , I believe the past five year continuous sell-off reflects fundamental and structural weaknesses in the business. This is not the "cigar butt" investment Warren Buffett once described. On the contrary, VFC increasingly resembles a classic value trap: a company with no clear signs of operational turnaround, and highly leveraged balance sheet that offers little financial flexibility and growing risk under a high uncertainty environment.

Over the past five years, VF Corporation has experienced a pronounced deterioration in both business fundamentals and market sentiment. Revenue has declined below 2019 levels despite inflation and portfolio reshuffling. The $2.1 billion acquisition of Supreme, attempted repositioning VF toward a younger demographic, failed to deliver strategic value. On the contrary, poor integration and weak performance led to the divestiture at approximately $1.5 billion — a ~$600 million capital loss, excluding any operational losses during the holding period. Meanwhile, core brands like Vans and Timberland have steadily lost cultural relevance, with product lines increasingly disconnected from consumer preferences. Once regarded as a reliable, dividend-paying apparel conglomerate, VF now appears structurally impaired — both operationally and financially.

Q4 FY2025 Earnings – Financial and Operational Overview

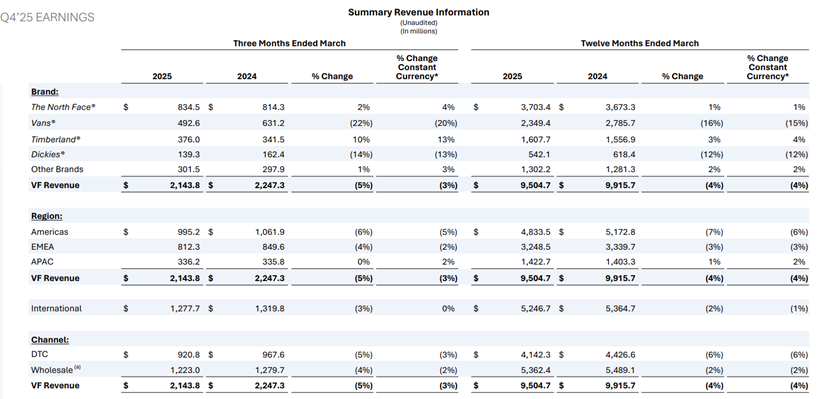

VF Corporation reported revenue of $2.14 billion for Q4 FY2025, a 9.7% decline compared to the same period last year. This was about $28 million below analyst expectations. The drop in revenue was seen across many areas, but the biggest reason was the poor performance of the Vans brand. Vans sales fell by 20% year-over-year, continuing the sharp decline seen in previous quarters. Management explained that part of this drop was due to “strategic reset actions,” but this was already the fourth quarter in a row of double-digit decline.

On a more positive side, The North Face and Timberland both reported growth, with sales up 4% and 13%, respectively. These gains came mainly from direct-to-consumer sales, strong demand for outerwear and footwear, and lower discounts rate. However, this growth was not enough to compensate for the large decline at Vans and Dickies.

The company’s gross margin improved to 53.4%, up 560 basis points from last year. This was helped by lower promotions, cleaner inventory and other cost saving measure. But operating margin remained weak at 1.0% (adjusted), even after improving compared to last year. SG&A expenses fell by 2%, mostly due to cost savings from the company’s Reinvent plan.

Free cash flow for FY2025 was $313 million, which missed the company’s original guidance of $440 million. The main reason was a negative change in working capital during the fourth quarter.

What concerns me most is that management did not provide any plan or clear intention to restore top-line growth. Instead, their focus remains almost entirely on cost controls and margin management.

As stated by management:

l “We’re still in the early stages of repositioning Vans… revenue pressure will continue in the near term.”

l “We are not guiding to revenue growth in FY2026. Our focus remains on gross margin expansion and cost discipline.”

This lack of a revenue recovery roadmap reinforces the view that VF’s current strategy is reactive and defensive in nature, rather than growth-oriented.

Search Data Points to Structural Weakness at Vans

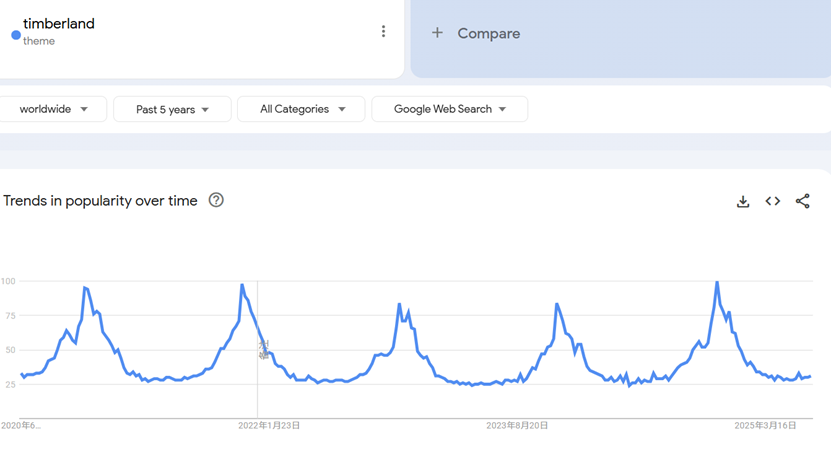

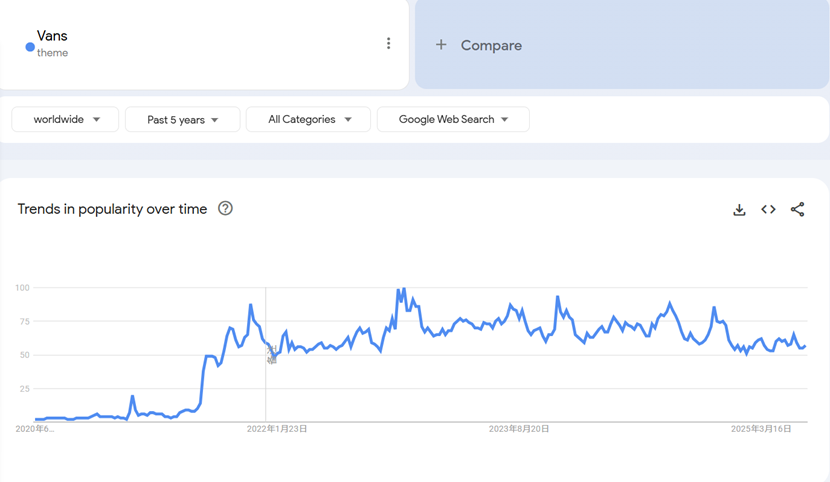

To assess consumer interest beyond reported sales, I examined Google Trends data for Vans, The North Face, and Timberland over the past five years.

The data shows a clear divergence among these brands:

The North Face and Timberland have maintained relatively stable search interest, with seasonal patterns but no major long-term decline or growth.

In contrast, Vans shows a steady downtrend in global search activity since its peak in 2019–2020, indicating waning consumer attention despite recent restructuring efforts.

Meanwhile, the stable search trends for both The North Face and Timberland suggest that there has been no meaningful increase in underlying consumer interest. This indicates that the recent sales improvement for these two brands may be temporary, driven more by normalized inventory levels and reduced discounting promation than by a real recovery in demand. The downward trajectory in Vans’ search interest raises further doubts about the brand’s ability to recover through organic demand, especially given the lack of a clear growth strategy from management.

No Relief in Sight: VFC Faces External Demand Risks in Second Half 2025

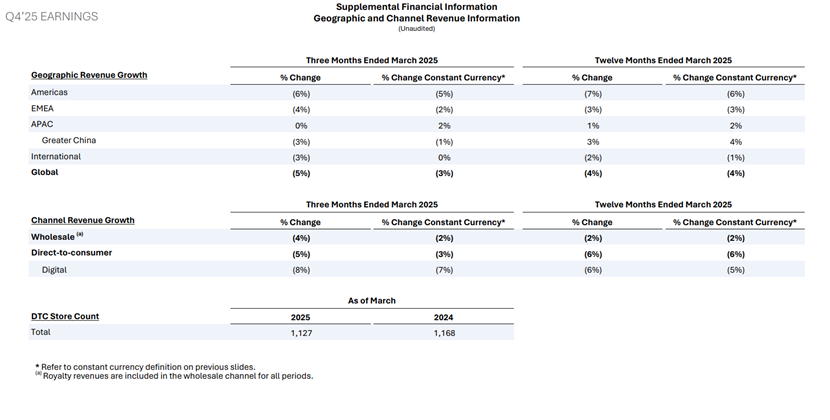

VF Corporation’s Q4 FY2025 results show that the Americas continue to be the primary source of revenue pressure, with sales down 6% year-over-year. In comparison, EMEA declined by 4%, and Asia-Pacific showed slight growth of 2%, indicating that international markets, while still soft, are faring somewhat better than the U.S.

However, recent economic data from Europe and China suggest that consumer spending is likely to deteriorate further in the second half of 2025. The most recent consumer sentiment remains deeply negative at –15.3, nearly unchanged from May and well below the long-term average.

Breaking it down by region:

In France, the INSEE Consumer Confidence Index stood at 88 in both May and June 2025, below first-quarter levels and historically weak.

In Germany, GfK Consumer Confidence declined to –20.3 for July 2025, with survey data indicating increased consumer preference for saving amid rising uncertainty.

In the United Kingdom, confidence improved marginally but remained firmly negative at –18, still well beneath the long-term average.

This broad-based weakness in sentiment highlights sustained pressure on consumers across key markets, diminishing the likelihood of a demand-driven recovery for VF Corporation in the near term.

While the Asia-Pacific region recorded a slight year-over-year growth of 2% in constant currency during Q4 FY2025, however, its contribution to VF Corporation’s overall revenue remains limited—only accounting for approximately 12% of total revenue. Furthermore, the most critical market within APAC—Mainland China—continues to face persistent deflationary pressures, weak retail sales, and low consumer confidence have weighed heavily on discretionary spending.

These macroeconomic indicators raise serious doubts to me about the modest improvements observed in Europe and Asia-Pacific during the second half of FY2026 is sustainable or not.

The U.S. remains the weakest-performing region. Sales in the Americas declined 6% year-over-year in Q4 FY2025, marking the steepest regional drop across the company’s geographic segments. More importantly, this account for about two-thirds of of total revenue.

To make matters worse, the U.S.—which had been the most resilient consumer market in recent years—is now showing early signs of Cracks In reviewing the latest Q1 2025 earnings reports from major consumer lenders such as Discover, Synchrony Financial, Capital One, and Bank of America and etc., several concerning trends emerge: credit card delinquency and charge-off rates have reached multi-year highs, especially among subprime borrowers; banks are increasing credit loss provisions; and consumer repayment behavior is shifting toward minimum payments.

All these data points suggest that U.S. consumer spending capacity is weakening, a troubling signal for VF Corporation’s most exposed market. Which makes me concern that the revenue of VF Corporation in US may continue to further delice during the second half of 2025.

Although management expects gross margin to improve in the next quarter, mainly the result of internal cost reductions, not a recovery in consumer demand. At the same time, macroeconomic data shows further weakness in spending across the U.S., Europe, and China is likely in second half of 2025. This raises concerns that VF Corporation is only delaying the impact of falling revenue by cutting costs.

Without a clear plan to grow sales, the company may face a downward spiral, where improving margins becomes harder to achieve and maintain over time and cashflow from operation continuous deteriorate. This could further hurt their operating cash flow—which is especially critical for a highly leveraged company like VFC .

Debt Overhang Remains a Structural Challenge

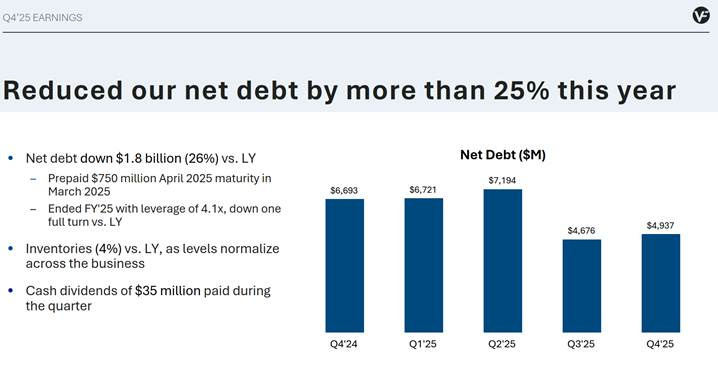

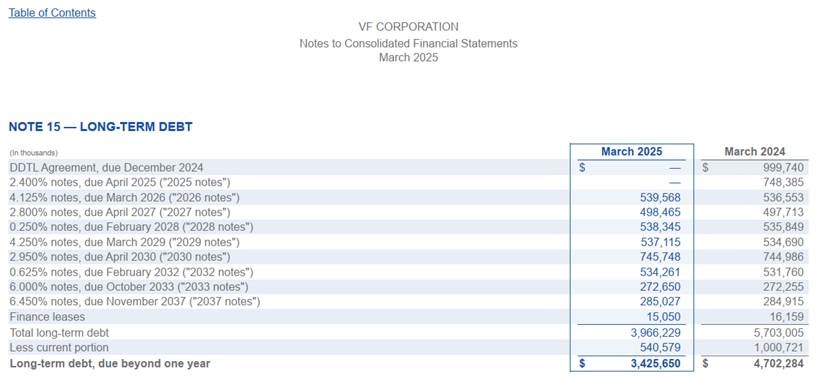

For VF Corporation, one of the most pressing structural challenges remains its substantial debt burden. As of the latest quarter, total long-term debt stands at approximately $5.9 billion, with material maturities due within the next 2–3 years.

Management directly acknowledged this concern in the Q4 FY2025 earnings call, stating:

l “We remain committed to deleveraging the balance sheet, and are focused on improving our credit profile over time.”

l They also highlighted that some progress has already been made:

l “We repaid $300 million of outstanding debt in the fourth quarter, which reflects our disciplined approach to capital allocation.”

While VF Corporation repaid $300 million of outstanding debt in the fourth quarter demonstrating capital discipline—this does not signal a fundamental improvement in the company’s debt profile. Total long-term debt still stands at approximately $5.9 billion, and with significant maturities looming over the next 2–3 years, the overall leverage burden remains heavy.

Based on the recent 10-Q, FY2026 and FY2028, VF Corporation faces a series of meaningful debt maturities that will require substantial capital outlays. Specifically, the company is required to repay approximately $540 million in 2026, $498 million in 2027, and $538 million in 2028, excluding interest. This three-year window represents a critical refinancing and liquidity challenge, particularly given VFC’s already constrained free cash flow and elevated interest burden.

Cash Flow Requirements Outstrip Current Operating Capacity

Between FY2026 and FY2028, VF Corporation faces approximately $1.58 billion in debt maturities. Further, this only reflects the principal repayment. When factoring in additional operational obligations, the true cash requirements are materially higher.

To stabilize operations, VFC will need to reinvest in working capital. A conservative estimate suggests annual working capital needs in the range of $200–300 million base on the current operation level.

In addition, the company continues to incur restructuring and transformation-related cash outflows, including store closures, severance costs, and supply chain realignments. Based on historical trends and management’s guidance, these could require minimum an additional $300 million within the next 2 years.

Plus other items. Such as interest expense, financial cost, VF Coperation will need to generate at least $2.5billion in cumulative operating cash flow over the next three fiscal years just to cover debt repayments, working capital, and restructuring costs.

In comparison, VF generated only $465 million in operating cash flow in FY2025. This wide gap created a fundamental issue: without a sustained recovery in revenues and margins, This poses a significant financial risk to a company already burdened with high leverage. As interest expenses rise and macroeconomic headwinds persist, the path to balance sheet normalization remains narrow and fraught with uncertainty.

To make the situation even wrose, Moody’s recent downgrade of VF Corporation—citing its weak credit metrics as of March 2025 (debt/EBITDA at 5.1× and EBITA/interest coverage of only 2.1×)—underscores the company's fragile financial position. As the ratings agency warned:

“While we view the transformation initiatives positively … the difficult consumer spending environment and uncertain tariff environment present notable risks to realizing and sustaining the revenue and gross margin improvements required to improve credit metrics to levels that are reflective of a Ba2 rating.”

Source: https://sgbonline.com/vf-corps-debt-ratings-downgraded-by-moodys-on-vans-turnaround-challenges/?utm_source=chatgpt.com

Rated Ba2 with a negative outlook, VF is officially classified in speculative grade. And that matters—when seeking external financing over the next three years, the company will it must now contend with high-yield borrowing costs.

Currently, Moody’s seasoned Baa-rated corporate bonds yield around 6.1%, while Ba2-rated bonds typically carry yields in the 7–9% range, adjusted for duration and current risk sentiment. The downgrade alone effectively adds at least 100–200 basis points to VF’s future cost of debt, creating further strain on a cash flow already stretched thin.

Strategic Options Are Narrowing — And the Worst May Still Lie Ahead

Based on the analysis above, VF Corporation faces a stark reality: unless it can meaningfully improve its operating cash flow beginning in FY2026, the company will be unable to cover its upcoming debt maturities and structural cash needs without further deteriorating its balance sheet. Unfortunately, the current macro backdrop remains unfavorable—consumer spending is under pressure across the U.S., Europe, and Asia, and management has offered no credible strategy to reinvigorate top-line growth.

This leaves VF with only two viable options to close the cash flow gap:

Asset sales, potentially involving its most valuable brands or real estate holdings; and

Eliminating its dividend, which consumed $140 million in cash last year alone.

Even with these aggressive steps, VF is unlikely to return to meaningful growth over the next 4–5 years. The base case, at this point, is a prolonged stagnation—a “dead money” scenario where shareholders see little to no return while the company struggles to stabilize its finances.

Put simply, the worst may not be over. VF may still be in the early stages of a multi-year deleveraging and restructuring cycle, with significant execution risk and limited strategic flexibility.

Conclusion: A Classic Value Trap

Despite the low valuation, VF Corporation shows no clear path to revenue recovery. With weak consumer demand, rising interest costs, and heavy debt obligations, the company lacks the cash flow needed to stabilize its balance sheet. Unless management executes major asset sales or revenue growth returns—both unlikely in the current macro environment—VFC is not a bargain, but a value trap. For now, it's dead money.